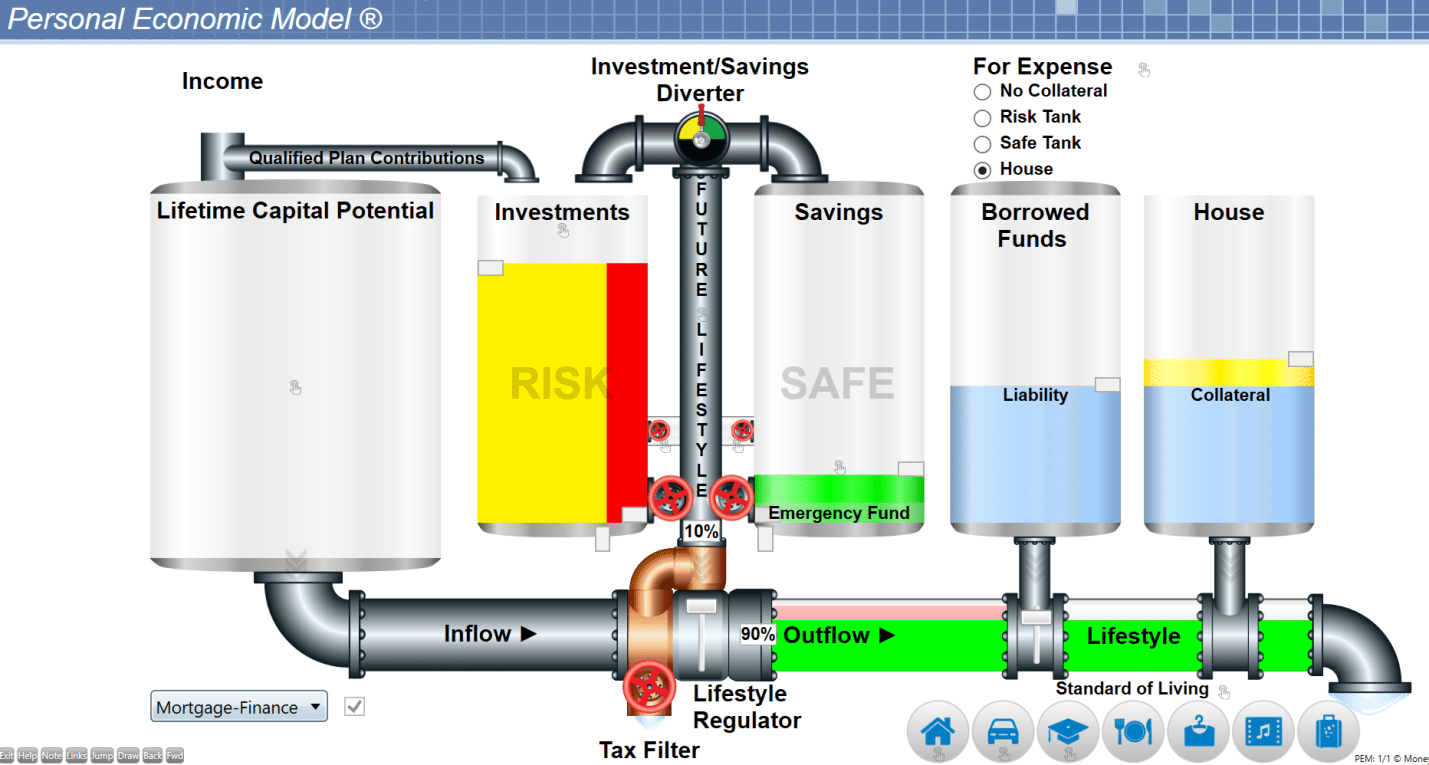

The Personal Economic Model® will give you a visual picture of how money flows in your financial life. This video is designed to view your money from perhaps a different perspective than you have ever seen before. What you learn may help you to increase the overall efficiency of how you manage a very important part of your financial life called cash flow.

Should you decide to work with me, my job is to provide you:

-

The information you need to determine where you are today

-

Help you visualize where you want to be in the future

-

Help you achieve the balance between your Savings and Investment dollars - preferably without you having to change your current lifestyle

How does what I do meet with what you are looking for?

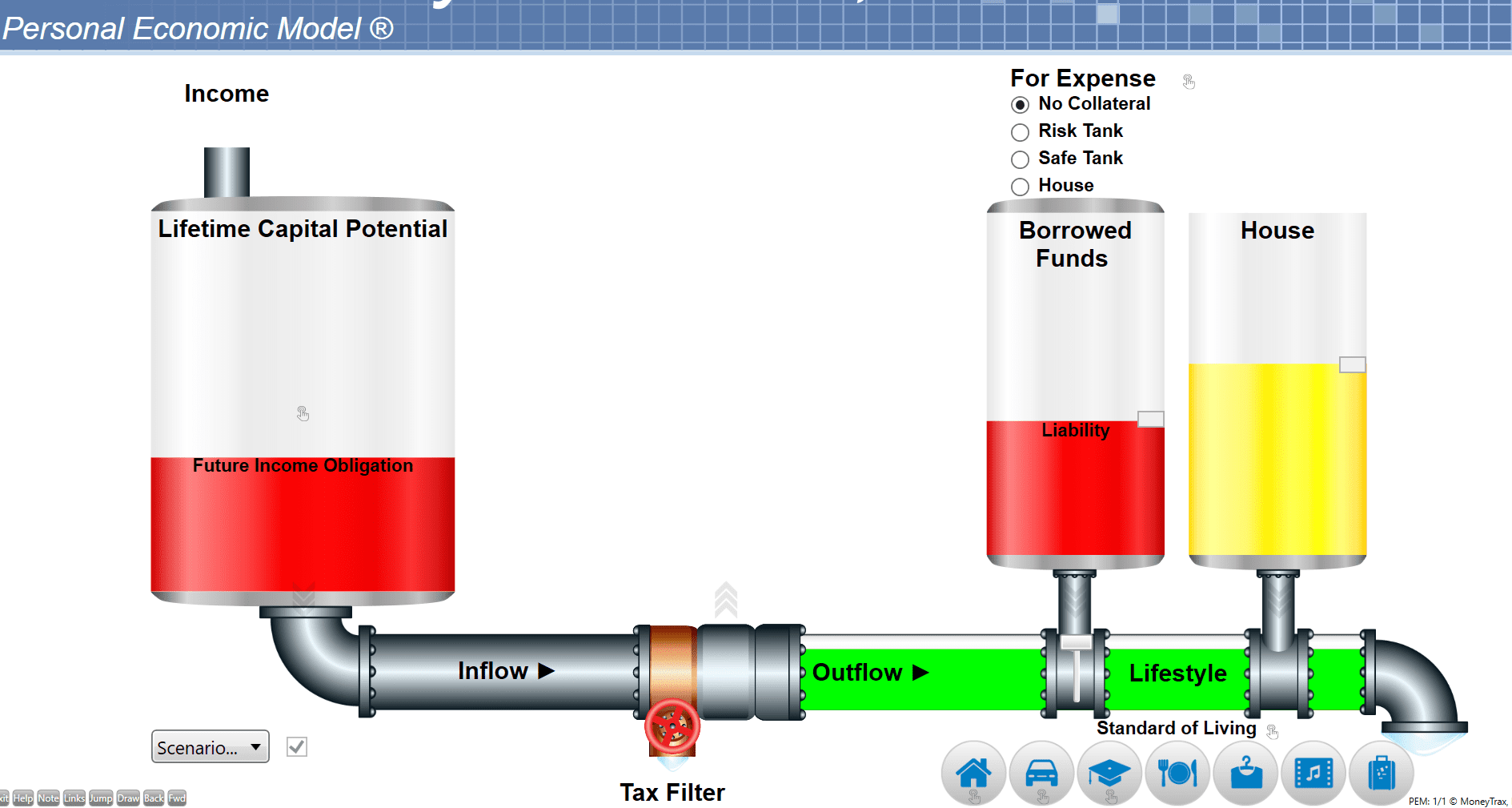

What is wrong with this picture? This is the picture of a family (or person) living paycheck to paycheck. Income comes in the Income tube on the upper left, flows through the Lifetime Capital Potential tank and then through the Inflow tube, through the Tax Filter for the government to get their hands on your hard earned money. Your remaining Income flows through the Outflow tube to support your Current Lifestyle.

What money is not used to pay current bills, such as, your utilities and house mortgage (if you have one), goes towards Borrowed Funds (Debt Liability). Debt is a Future Income Obligation that robs you of Future Lifestyle. No money is pumped up the Future Lifestyle tube (missing in this picture) to fill the Investment and Savings tanks to support your retirement. One day your Income flowing through the Income tube will be shut off. Trust me, retirement comes faster than you can possibly imagine. You already know how fast time flies since you graduated from high school. Been to any reunions yet?

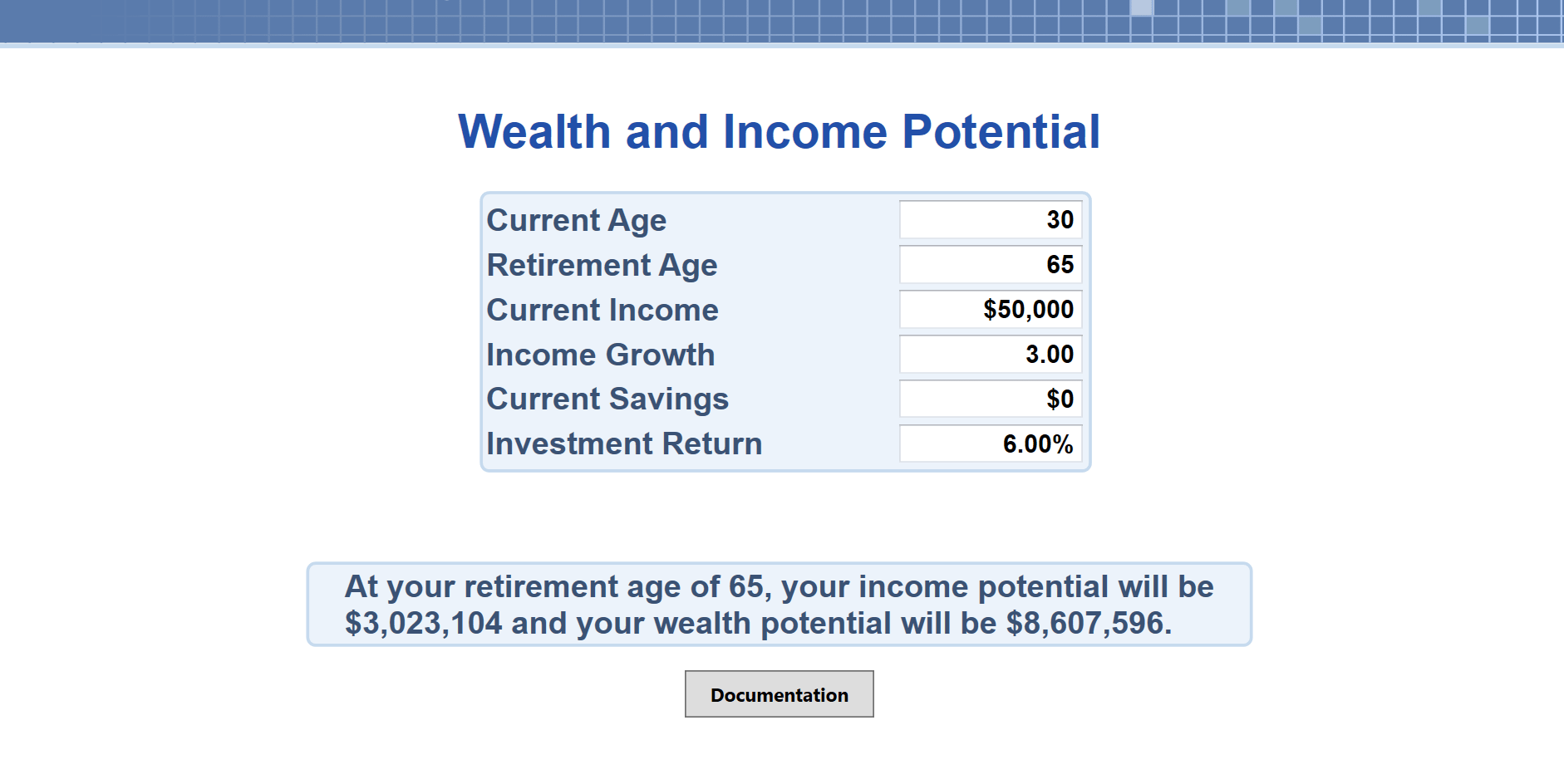

There are a number of reasons people do not save. I want to encourage you to save… get in the habit of paying yourself first before life gets in the way and robs you of your Future Lifestyle. A lot more money will flow through your hands over your working lifetime than you realize.

This example shows a 30 year old working for the next 35 years and retiring at age 65. The potential of $50,000.00 in annual income growing 3% per year due to cost of living increases and promotions for 35 years amounts to $3,023,104. If you did not have any bills to pay or Lifestyle to support; that $50,000.00 growing 3% a year being Invested or Saved at 6% for 35 years would grow to $8,607,596. Do not under estimate your Wealth and Income Potential. A lot of money will be flowing through your hands over your working years.

Welcome to COW Specialist

We are your circle of wealth specialist. At COW Specialist, we offer professional, independent, and most of all, personalized service to our clients. We are a small team of experienced professionals who know our clients by name and work hard to ensure your financial needs are assessed and met.

-

Financial Planning

-

Retirement Strategies

-

Retirement Planning

-

College Planning

-

Estate Planning

-

Annuities

-

Life Insurance

-

Disability Income Insurance

Services

Depending on where you are in your financial stage of life, you'll want to talk with an experienced adviser about different things. As we describe our services, we categorize them in line with the financial stages you'll experience during your life.