Investments

AVERAGE ROR VS. REAL ROR

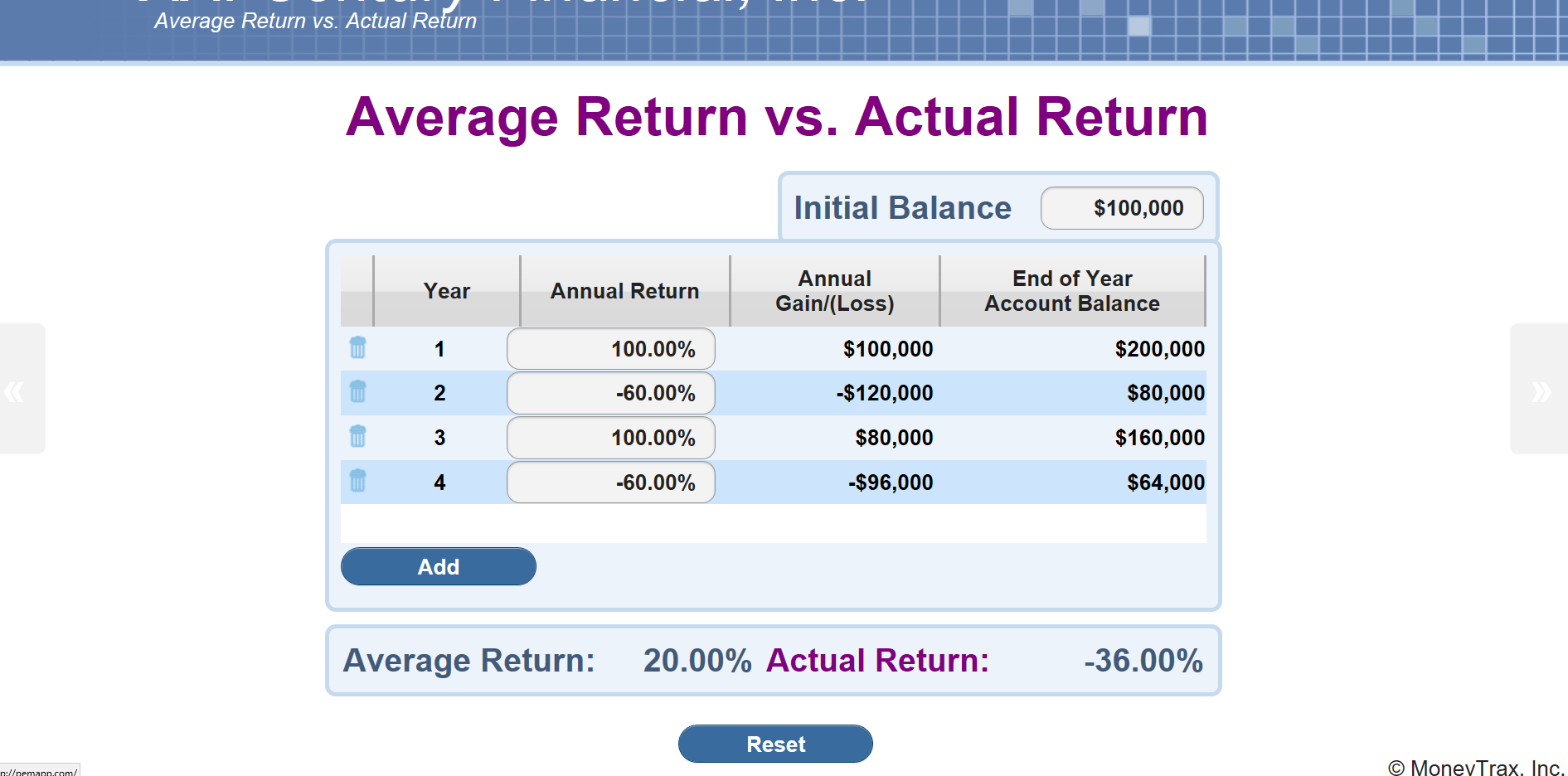

The following is for illustrative purposes only, the returns used are not possible and are only used to illustrate a concept.

Suppose you started with a $100,000 and earned 100% the first year. Now you have $200,000. In year two you lost 60%. Now you only have $80,000. Your average rate of return was 20% but your real return was -20%. Don’t get fooled with averages, focus on the real or actual rate of return potential.

Have you seen the TV commercial where the guy says; “We know a thing or two because we’ve seen a thing or two”? You need to know a thing or two about retirement planning because you are ultimately responsible for your retirement nest egg. I want to show you "a thing or two" about Wealth Creation.

WEALTH CREATORS have knowledge of financial principles that DEBTORS and SAVERS either do not know about, or do not apply to their financial lives. Let’s take a look at a couple of them.

The following is for illustrative purposes only, the returns used are not possible and are only used to illustrate a concept.

If I could offer an investment where there is the potential to receive a 20% AVERAGE RATE of RETURN at the end of 4 years… I believe a lot of people would be interested.

WEALTH CREATORS understand that AVERAGE Rate of Return1 is simply the ARITHMETIC MEAN of a group of Annual Returns. In other words, a STATISTIC!

The AVERAGE RATE of RETURN1 (20%) is calculated (100% + -60% + 100% + -60%) = 80 / 4 = 20%

Knowing what you now know… would you be happy with an Average Rate of Return of 20% on this $100,000 investment?

The ACTUAL RETURN1 on this investment is -36%. In other words, a financial calculation of the MONEY LOST! It went from $100,000 down to $64,000.

Actual Return on Investment = ((Ending Balance / Starting Balance) - 1) * 100

Don’t be led astray by the statistical term AVERAGE RATE of RETURN.

If you research Average Rate of Return you will discover that it is calculated in a variety of ways by those wanting to use it to prove their point. This only causes further confusion. I speak of AVERAGE RATE of RETURN and ACTUAL RATE of RETURN or Return On Investment (ROI) as defined by the:

1 Dictionary of Finance and Investment Terms.

COMPOUNDING vs. SPECULATION

One way to lessen financial loss in a volatile Stock Market is by the use of financial resources using Compound Interest as a growth strategy. “Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.” ― Albert Einstein

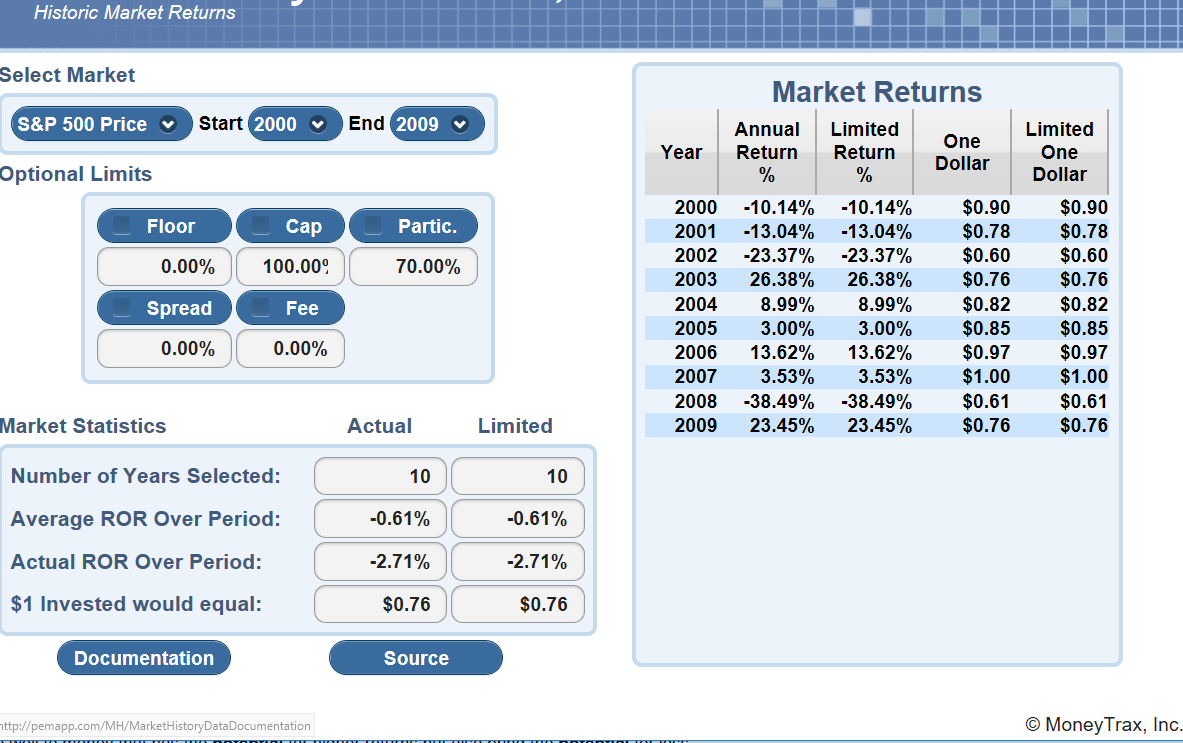

During the decade of 2000 to 2009 known as "The Lost Decade" one dollar invested at the beginning of the year in 2000 became $0.76 at the end of the year 2009.

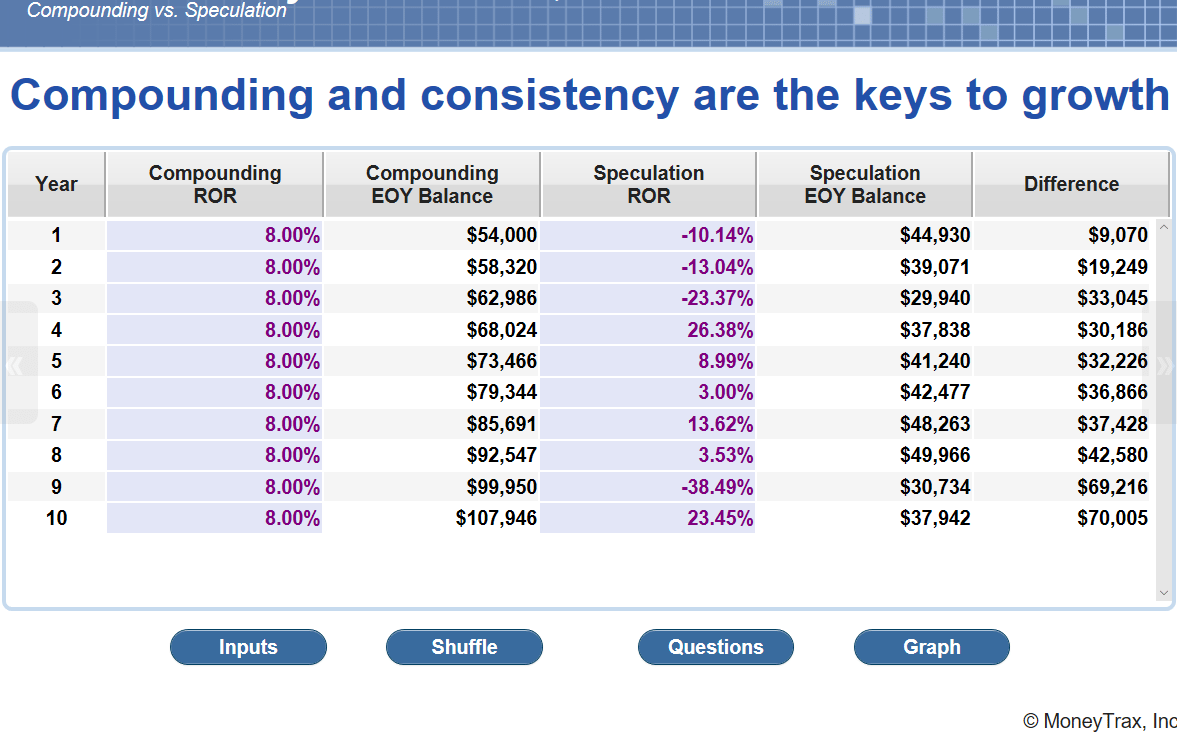

On the LEFT side of the Compounding and consistency spreadsheet you have GREEN TANK or SAFE (Refer to the Personal Economic Model®) money COMPOUNDING at 8% for 10 years.

On the RIGHT side of the Compounding and consistency spreadsheet you have YELLOW TANK (SPECULATIVE) money in the Stock Market represented by the S&P 500 Price index for the same 10 year period.

Speculative money:

In year 2009 you ended up with $37,924. That’s $12,076 LESS than what you started with in 2000.

Actual Return on Investment YELLOW TANK money =

((Ending Balance / Starting Balance) - 1) * 100

((37,942 / 50,000) .75884 -1 -0.24116) * 100 -24.116%

Compounding and consistency:

In year 2009 you ended up with $107,946. That is $57,946 MORE than what you started with in 2000.

Actual Return on Investment GREEN TANK money =

((Ending Balance / Starting Balance) - 1) * 100

((107,946 / 50,000) 2.15892 -1 1.15892) * 100 115.892%

WEALTH CREATORS understand the financial principle of COMPOUND INTEREST:

Over time…

Uninterrupted…

At a reasonable rate of return…

Can compare quite well to money that has the potential for higher returns but also bring the potential for loss.