Taxes

Do people pay more taxes than they have to? The obvious answer is yes, but not because they want to. Most people would prefer to avoid taxes today at almost any cost. Hence, one of the most common recommendations of where to place your money to grow for the future is in Qualified Retirement Accounts. The most common of these being the 401(k).

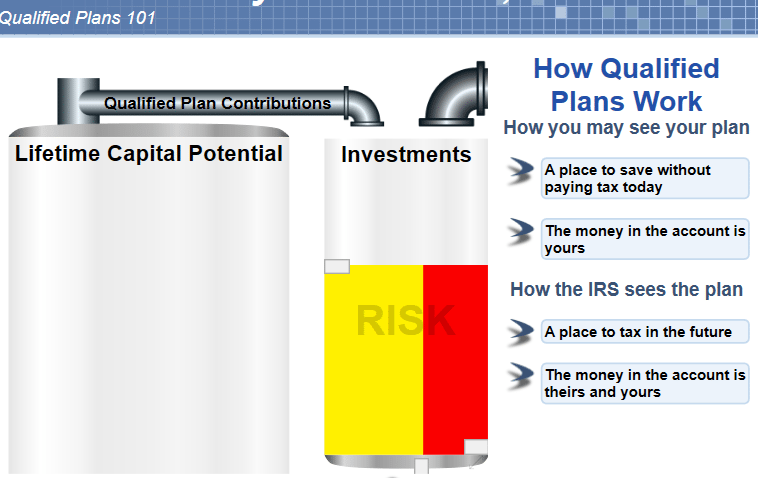

In the video, The Power of Zero Documentary, Don Blanton, President, MoneyTrax, Inc. states that Qualified Plans do 2 things:

-

They do defer (postpone) taxes which is the part we are most interested in at the time of our contribution.

-

They also defer (postpone) the tax calculation. Push the PAUSE button and let this run past your brain for a few minutes.

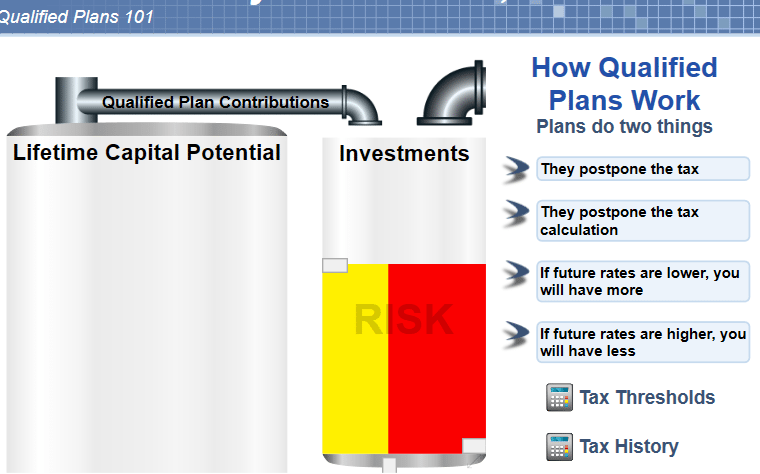

Your tax bracket plays a very important role in this discussion. Many Americans focus on the tax bracket they are in today, not the one they will be in when they take the money. The truth is they are both important but most focus their attention only on the contribution.

What Tax bracket will you be in when you take this money out? This question should receive more attention than it is getting from most. Let's assume you are investing money in a Qualified Retirement Account. You probably thought doing so would save you taxes. You may have even received information from tax professionals that you will "save" taxes. The truth is these accounts are not tax savings accounts at all, but tax deferred savings accounts. That means that you will pay the tax eventually. The pressing question is: at what bracket?

If you take the money out in a lower tax bracket than when you put it in -- you win. You did save taxes but you cannot know that today. When you have to take it out, and you are in a higher tax bracket -- you lose.

Taxes and Qualified Plans are quite possibly 2 of the 5 major areas in your financial life where you are losing money unknowingly and unnecessarily (See the Wealth Transfers webpage.) The federal government gets their money up front in the form of payroll taxes. An exception to this event is Qualified Retirement plans (401(k)) where you postpone paying the taxes you owe the federal government on your Deferred Qualified Retirement plan when you withdraw the money. Your Qualified Plan is growing at interest and your tax bill to the federal government is growing at interest as well.

Qualified Plans. Many Americans focus on the tax bracket they are in today, not the one they will be in when they take the money.

If you participate in a Qualified Plan you need to know the answers to these questions:

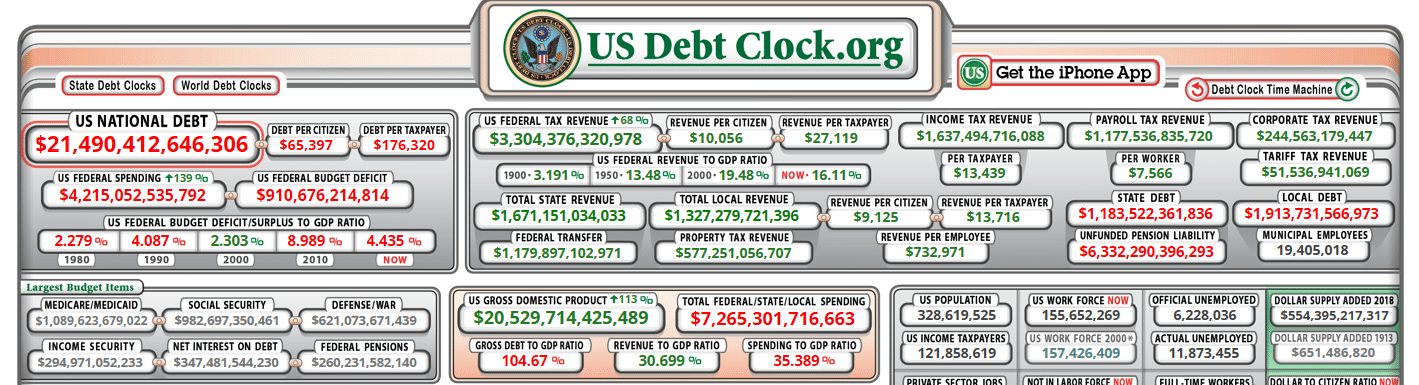

How Qualified Plans work

Who's money is in a Qualified Plan

What is meant by Apparent taxes deferred

How Qualified Plans Work

Who's money is in a Qualified Plan?

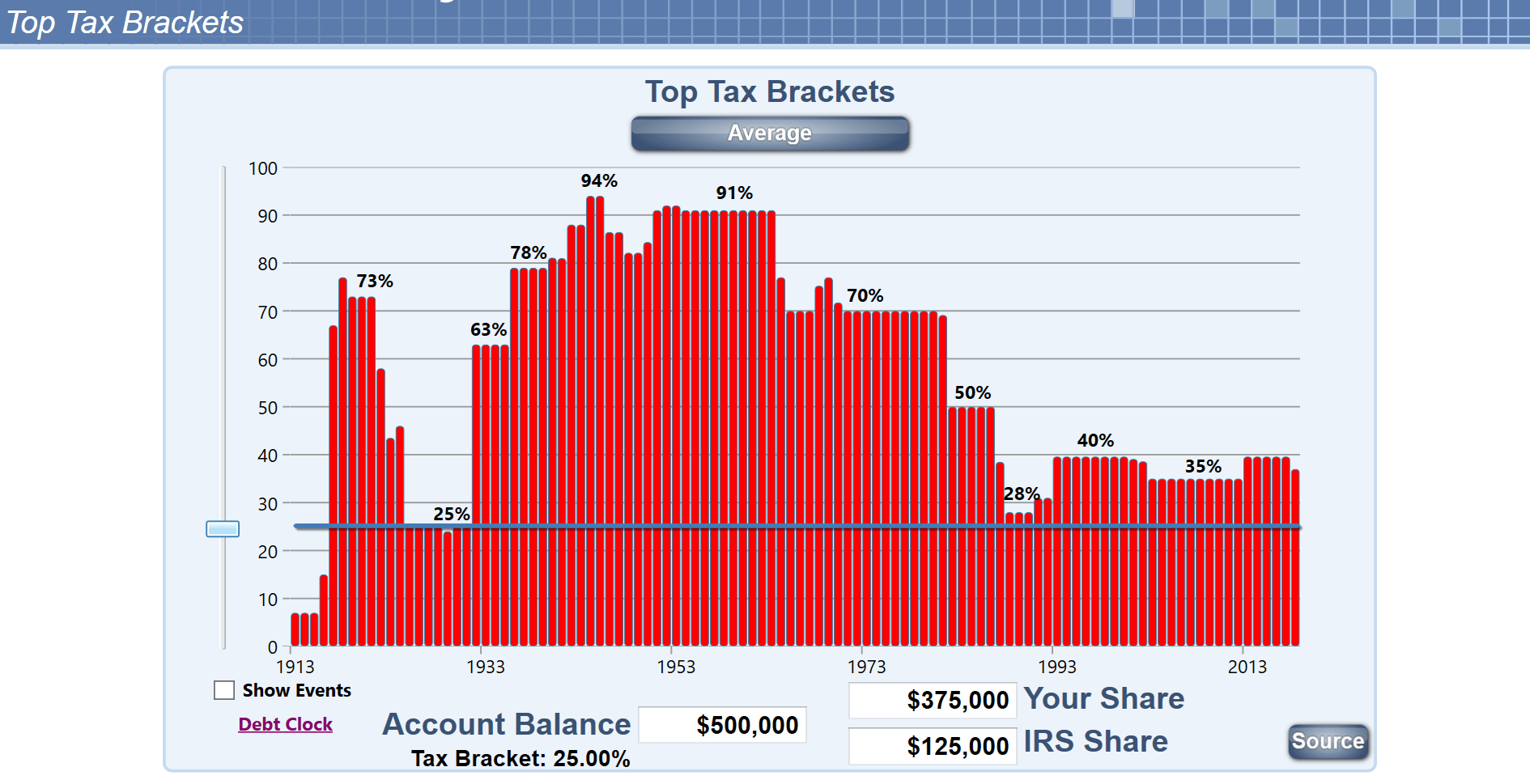

You have done all of the right things. You have worked hard. You have invested and now it is time to retire and enjoy your senior years. How much of your $500,000 Qualified Plan (401(k), 403(b), Deferred Compensation, IRA, etc. ) Account Balance is yours? Well, that depends on what Tax Bracket you will be in when, by law, you have to withdraw that money from the account and start paying taxes on it. How does it feel to have the federal government as a major partner sharing in your hard-earned retirement money. Your Qualified Plan (401(k)) money is in the Yellow or RISK tank (see Personal Economic Model®). If the Stock Market declines, will the federal government take a lesser share of your retirement money? NO, but, you will probably have to tighten your belt to make ends meet during a down Stock Market period. Who's money is this anyway? The federal government sees your Account Balance as theirs to tax first, and what’s left over being your retirement nest egg. If the federal government can raise taxes at the stroke of a pen; is this money really yours?

What is meant by Apparent taxes deferred?

Let’s assume you are investing money in a Qualified Plan account. You probably thought doing so would save you taxes. You may have even received information from tax professionals that you will “save” taxes. The truth is these accounts are not tax savings accounts at all but tax deferred savings accounts. That means that you will pay the tax eventually. It is impossible for anyone to tell you how much money you will “save” by making a contribution today to a Qualified Plan. It is impossible because they do not know the withdrawal tax bracket.

An interesting thought: At the time of withdrawal the IRS is not going to ask you what tax bracket you were in at the time of your contribution, their only concern is what bracket you are in at the time of withdrawal.

What tax bracket will you be in during retirement? Higher, lower or the same?

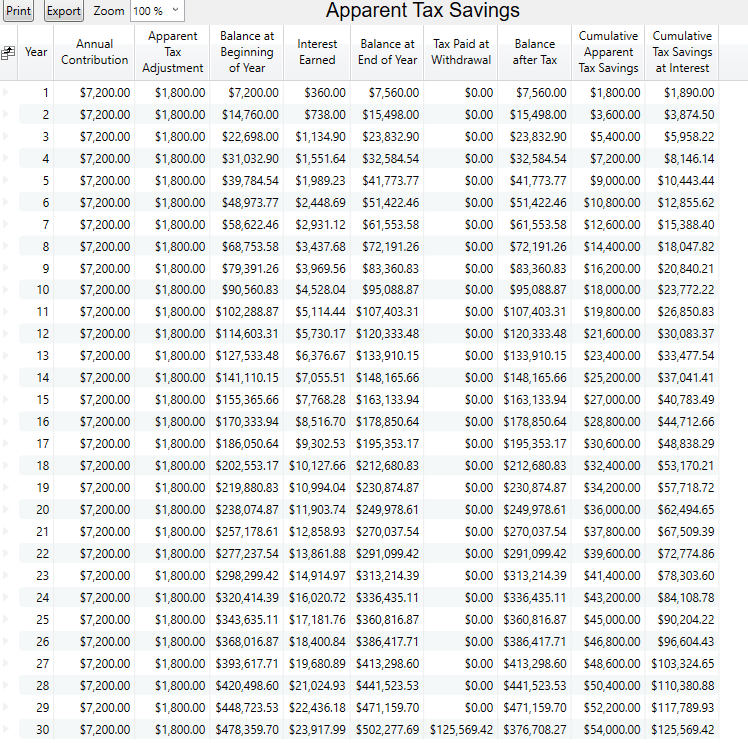

Assume you are in a 25% tax bracket and you wish to make an annual contribution of $7,200 to your Qualified Plan. The best one could and should say is that the “apparent tax benefit” of making a $7,200 contribution today would be $1,800. What many miss is the fact that the $1,800 you “saved” in taxes today will be due at interest in the future. You contributed $7,200 to the plan but you only have $5,400 in the plan. The federal government has their share ($1,800) in the plan as well. Had you claimed the $7,200 in income you would have paid your tax of $1,800 and received the balance of $5,400.

The federal government is allowing you to defer the tax. You did not save any tax. You did not get a check in the mail from the federal government, you simply did not have to pay it today. The money you think you are saving is actually in your Qualified Plan account. The federal government understands Opportunity Cost. What Opportunity does the federal government have with your money? They will have the Opportunity to get their $1,800 back one day at interest. Your share ($5,400) earned interest and so did theirs ($1,800). Should they decide they want more and raise taxes when you start taking the money out; your share of the money goes down.

If the Qualified Plan account value grew to $502,278 your share would be $376,708 and the federal governments share would be $125,569 assuming a 25% tax bracket. If you listen to the wisdom of many advisors you will hear that deferring your taxes is a good thing because when you retire you will be in a lower tax bracket. They are not necessarily wrong because most people do retire in a lower tax bracket. The reason is not that taxes are less during their retirement years, but rather, most Americans are broke at retirement. Most cannot afford to retire at the same level of income they were making while working. Sad but true. The federal government reports that you can get by on 60% to 70% of your present income at retirement. There are few people who will be able to retire on two thirds of what they have a hard time living on while they are working.

The other problem with the myth “you will need less in retirement” is the fact that many things may cost more in the future. Many believe this factor will not be that large a burden because they plan to have their house paid off by the time they retire. Let’s assume your house is paid off by the time you retire. Will it be a problem during your retirement if your medical costs are more than your current mortgage payment? Will your property taxes be less during retirement? These are things that few advisors may take into consideration in planning for your future but may have an impact on your lifestyle during your retirement.

Do not misunderstand what we are saying. We are not saying these plans are bad. We are simply helping you understand what they do.