Wealth Transfers

It is possible that many of the answers for a successful financial life may be lying right in front of you and you simply cannot see them. Many people give away much of their wealth unknowingly and unnecessarily. These are called transfers of your wealth. It is very important to discover the transfers of wealth in your life. Once you recognize your transfers, you will have an opportunity to recapture the money that you are giving away. Learning this process will eliminate some of the unintended consequences of traditional financial thinking.

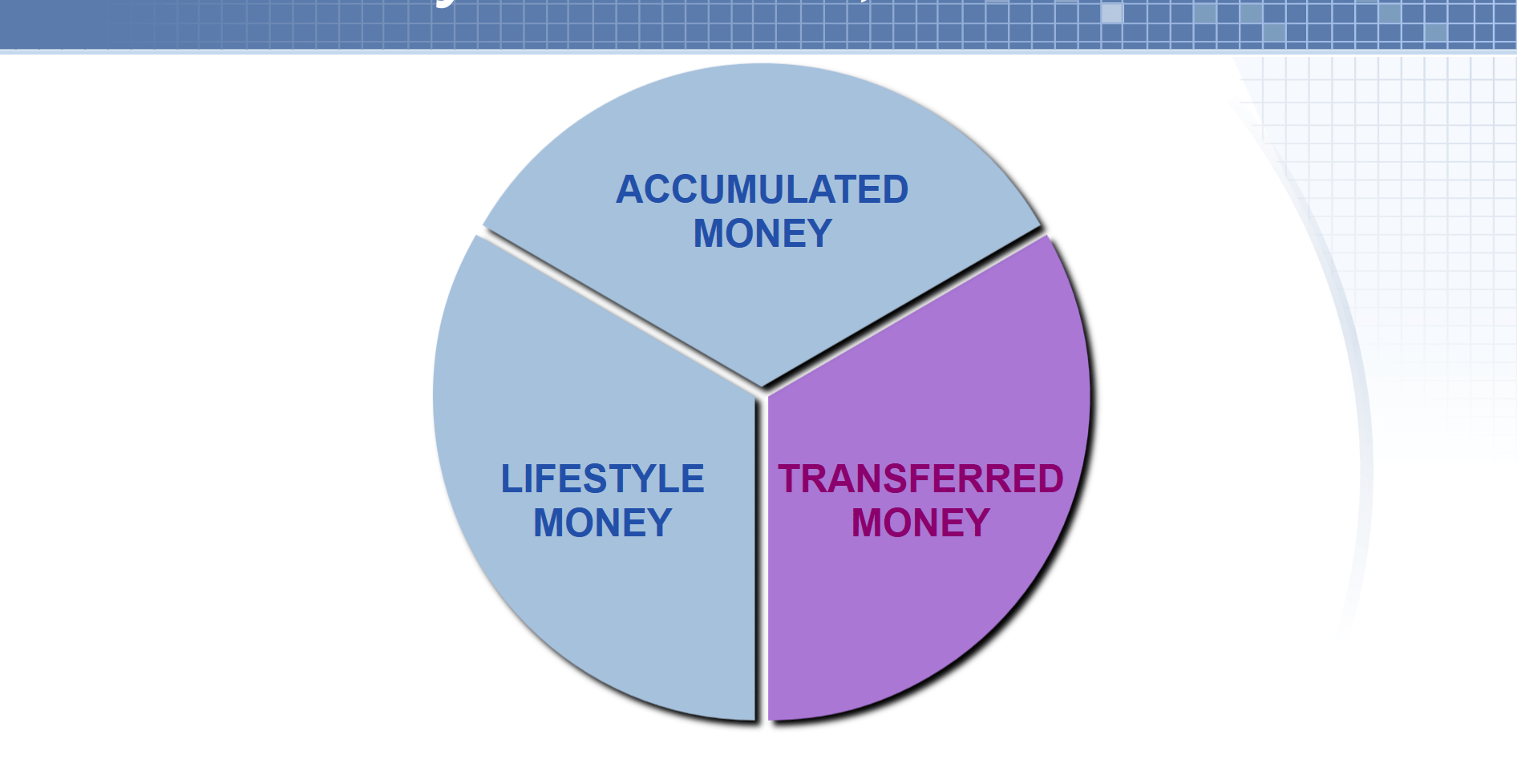

Your circle of wealth consists of three types of money: Accumulated Money, Lifestyle Money, and Transferred Money.

I am in the financial services business with a very unique approach in that I help people FIND MONEY they are currently losing unknowingly and unnecessarily.

There are only two ways a person in the financial services business can help people financially:

-

Find better products that potentially pay higher returns often requiring more risk

-

Be more efficient by avoiding unnecessary losses

My Philosophy

I believe there is more opportunity to serve clients by helping them avoid the losses than by picking the winners.

Five Major Areas of Wealth Transfers

Where people are potentially losing money unknowingly and unnecessarily:

HOW YOU PAY FOR YOUR HOUSE

Representing one of the largest transfers of wealth in your life is your home. Owning a home is part of the traditional American dream.

We have been told that owning a home is one of the largest and best investments that we will ever make. If that is not true, when would you want to know about it? There are important questions that need to be discussed:

-

Is a house a good place to keep your money?

-

What is the rate of return on the equity in your house?

-

Should you pay your house off as fast as you can?

-

What can you learn from the financial upheaval in the residential real estate market back in 2008 and 2009?

TAXES YOU PAY

You paid income tax on the money that you invested when you earned it. If you choose a taxable account in which to invest, you first stood in the ordinary income tax line to earn the money you are investing, then instead of finding a tax deferred line or tax fee line to take your money, you went to the back of the ordinary income tax line and got in line again to pay taxes on the growth of your investment.

Perhaps the thing that makes the increasing tax burden go unnoticed is that most people pay the taxes due on taxable accounts from their Lifestyle not the Investment account. This can give the illusion that the account is growing faster than it actually is. Subtracting the tax due on the growth is known as "netting" which would give you a truer picture of how the taxable investment account is doing. Our experience is that few people actually do this in practice. Instead many pay their taxes from another pocket we call Lifestyle.

QUALIFIED PLANS. HOW YOU FUND YOUR RETIREMENT ACCOUNTS.

Do people pay more taxes than they have to? The obvious answer is yes, but not because they want to. Most people would prefer to avoid taxes today at almost any cost. Hence, one of the most common recommendations of where to place your money to grow for the future is in Qualified Retirement Accounts. The most common of these being the 401(k).

Let’s assume you are investing money in one of these accounts. You probably thought doing so would "save" you taxes. You may have even received information from tax professionals that you will “save” taxes. The truth is these accounts are not tax savings accounts at all but tax deferred savings accounts. That means that you will pay the tax eventually.

The pressing question becomes; “At what tax bracket will you pay the taxes you owe?”

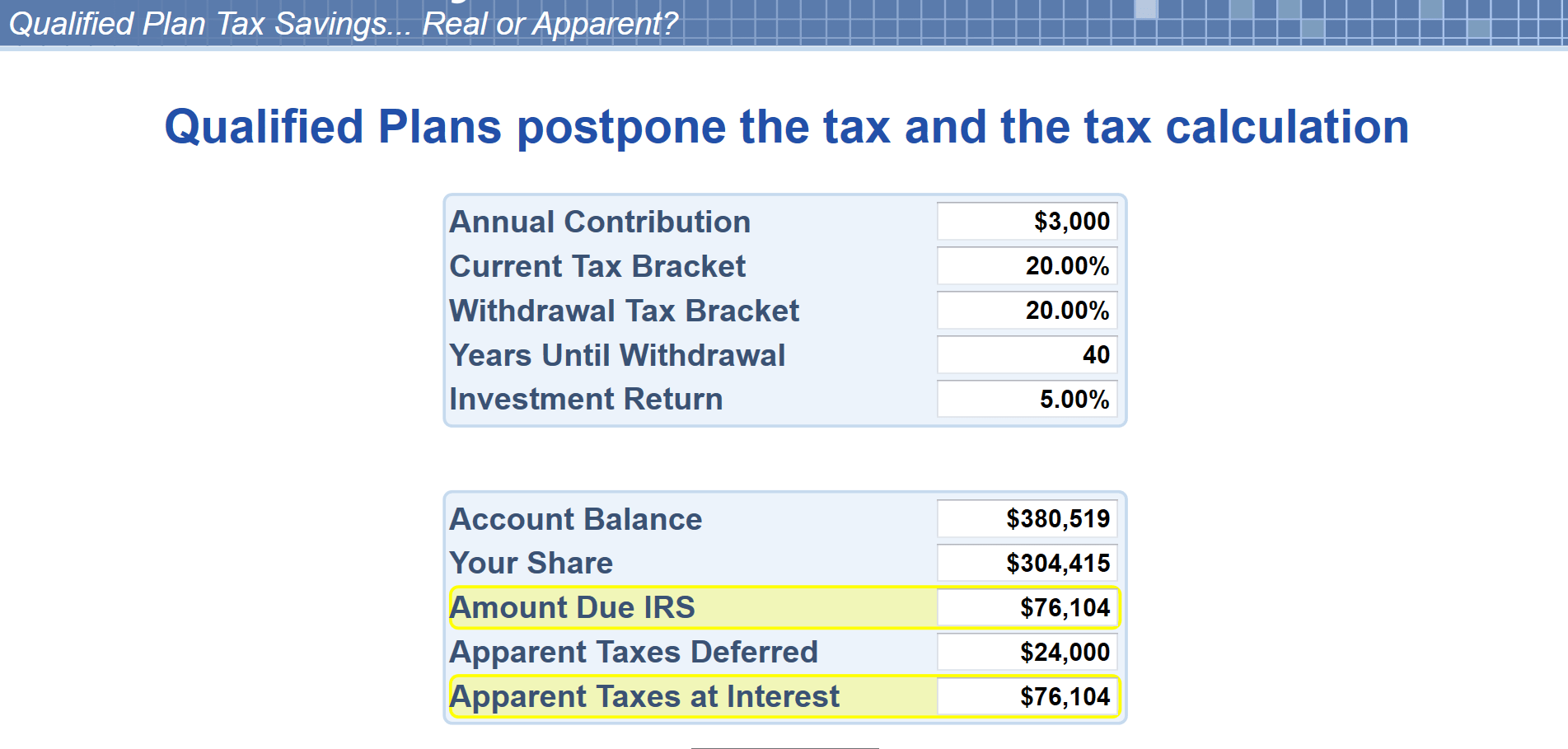

Since the tax bracket at the time of withdrawal is unknown it is impossible for anyone to tell you how much money you will “save” by making a contribution today to a Qualified Plan. It is not possible because they do not know the tax bracket at the time of withdrawal. Let’s assume you are in a 20% tax bracket and you will be in a 20% tax bracket when you withdraw the money from your Qualified Plan. You wish to make annual contributions of $3,000 to your Qualified Plan for the next 40 years, and assume a 5% investment return on your contributions. The best one could and should say is that the “Apparent Tax Benefit” of making $3,000 annual contributions would be the annual deferral of $600 in taxes.

What many miss is the fact that the $600 you “saved” (a better word would be postponed) in taxes today will be due the IRS at interest in the future. You contributed $3,000 to the Qualified Plan but you only have $2,400 in the plan. The government’s share of your Qualified Retirement Plan is $600. Had you claimed the $3,000 in income you would have paid your tax of $600 and received the balance of $2,400.

The government is allowing you to defer the tax. You did not save any tax you simply postponed it. You did not get a check in the mail for $600 when you made your contribution, you simply did not have to pay the tax today. The money you think you are saving is actually in your Qualified Plan. The government understands Opportunity Cost very well. They will want their $600 back one day at interest. Your share ($2,400) earned interest and so did theirs ($600). Should they decide they want more tax revenue, and taxes go up when you start taking the money out; your share of the Qualified Plan goes down.

This is in no way suggesting that putting your money in a Qualified Plan is not a good thing for you to do. However; what you do need to understand is how the game is actually being played.

EDUCATION EXPENSES. How you pay for your children's education costs.

It is reported by the Department of Education that the average cost for 1 year when attending a 4 year undergraduate institution is approximately $18,000. The actual cost can vary wildly, with some states averaging more than $20,000 per year for public institutions and private schools pushing $35,000 per year and higher.

The time it takes to earn an undergraduate degree is another factor that must be considered. Although we often refer to an undergraduate degree as a four-year degree, the statistics suggest that it is becoming less and less likely that a student will earn an undergraduate degree in less than 5 years.

A recent study reported by the Department of Education entitled Postsecondary Persistence and Progress, shows that about half of the student population attending a so-called 4-year institution will graduate in 4 years. At private schools, that number is nearly 70%.

MAJOR PURCHASES. HOW YOU PAY FOR MAJOR CAPITAL PURCHASES LIKE CARS, WEDDINGS AND VACATIONS.

A fundamental premise of compound interest is that it works best over time and without interruption.

The Private Reserve Strategy® will give you insight into how to maximize the power of compound interest not only in the money you are saving and investing for your retirement, but how you spend money as well.

What is the Private Reserve Strategy®?

It is a concept, an idea, a way to look at how money works. It is a strategy designed to help you develop or improve your financial position by avoiding or minimizing unnecessary wealth transfers where possible, and accumulate an increasing pool of capital that you can access and control.

Some wealth transfers are avoidable. Others you can only minimize.

Example. For most of us, owning a car is an unavoidable expense. How we pay for the car can help to minimize the expense… meaning that some methods of paying for the car could be better than others.

You finance everything you buy. You either give up the ability to earn interest, or you pay interest.

You might be saying to yourself; “I don’t finance, I pay cash.” The reality is you are financing because you must make payments back to yourself to get back to the same financial position you were in before you made the purchase.